Removing the manipulated seasonal adjustments will give you a better sense of what the CPI is doing without all the shenanigans. Today we will look at the data just released.

CPI For the 12 Months Ending 3/2024

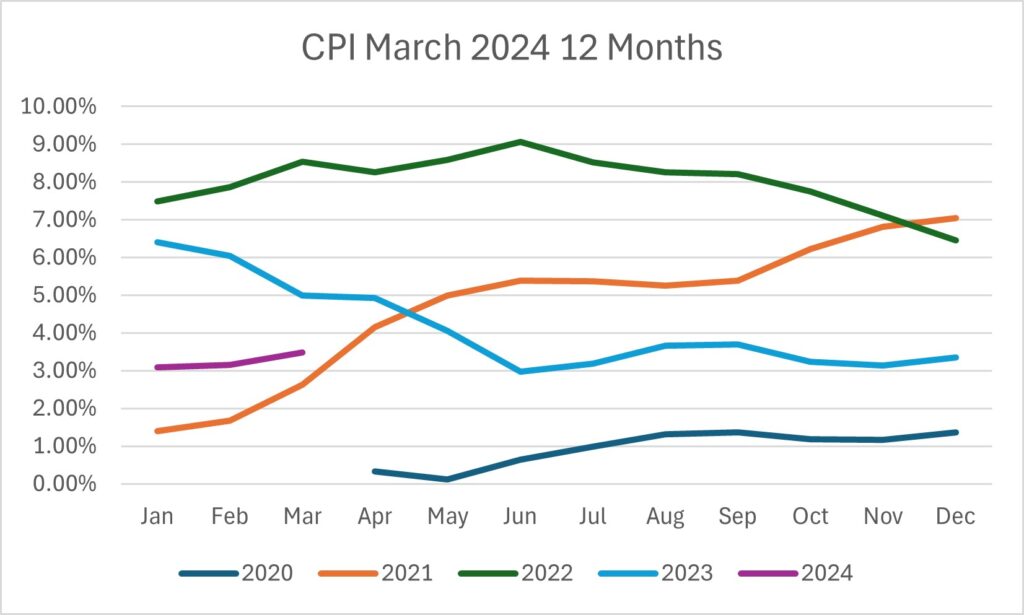

The CPI for the 12 months ending 3/2024 is 3.48%. This is down from 12 months ago which came in at 4.94%.

It is also down from 24 months ago, which came in at 8.54%

The CPI is also down from the 12 months ending September 2023 of 3.70%(where we were six months ago).

Over the Last Five Years

While down from the 12 months ending 3/2023, the rolling 12-month CPI increased from February 2024 by 0.33%, from 3.15% to 3.48%.

The CPI peaked at 8.58% in May 2022 and has fallen more than 5% since the peak.

The lowest CPI for a 12-month period was 0.12% for the 12 months ending May 2020, which occurred during the COVID shutdown..

The Federal Reserve Bank (FRB) has a stated objective of 2% for inflation.

To review the data directly from the BLS, you can go to their site and download the data directly.