Corporate profit growth is an excellent indicator of the health of an economy. After all, the reason one is in business is to generally grow profits.

As I have written in years past Know Profit No Growth (No Profits No Growth)

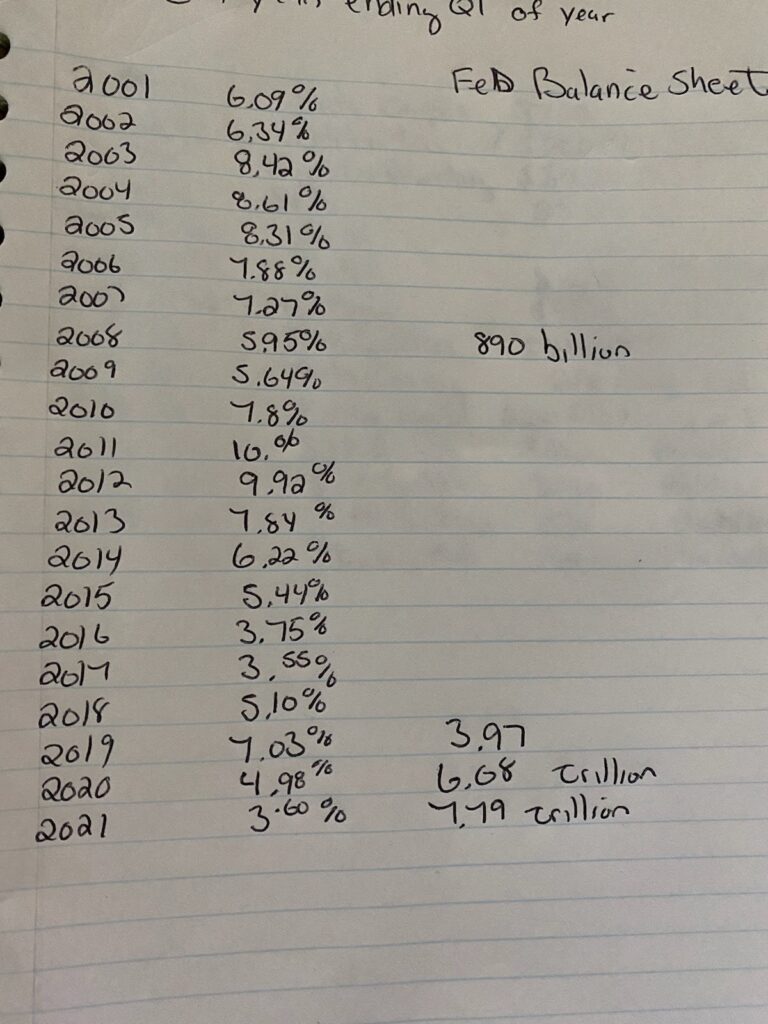

For the 10 years ending the first quarter of 2021, profit growth has fallen to 3.6% annually. Compare that to the ten years ending the first quarter of 2011 and you see just how poor we are doing: 10%.

Think about that. With all of the Fed easing, corporate tax cuts, ultra low interest rates and government giving out money, we have 1/3 of the growth of the previous decade.

So is the Fed keeping us afloat, or are they the cause of what ails us. I know what I believe. Below is an image of the rate of profit growth annually for the ten years ending in the year listed (first quarter each year). And for kicks, I’ve included the numbers of what the Fed balance sheet was along the way.