Employment Numbers Are A Driving Market Statistic

Twelve times a year the financial markets sit on the edge of their seats waiting for the release of the Non-Farm Payroll data. Stock prices can soar or sink, politicians can claim success or suffer negative headlines and in theory, businesses just might alter future business plans based on what they are seeing.

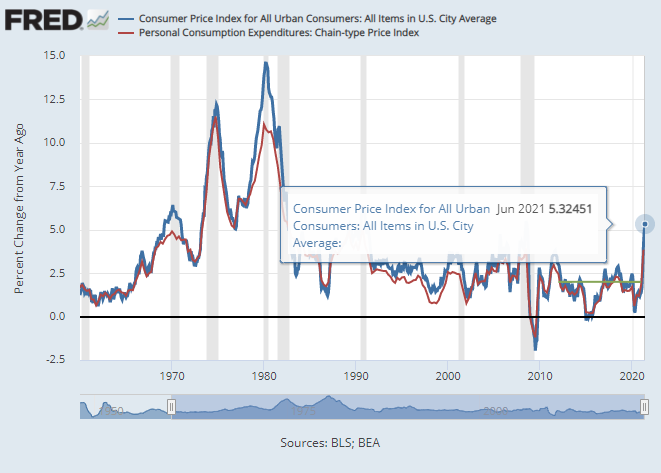

Earlier this month I asked if we live in a seasonally adjusted world:

https://ejmoosa.com/do-you-function-in-a-seasonally-adjusted-world/

What other aspects of our life are seasonally adjusted when we are given the data? Not many if any at all. You would not shop for a vehicle using seasonally adjusted pricing. Nor would you dress properly for winter with a seasonally adjusted forecast.

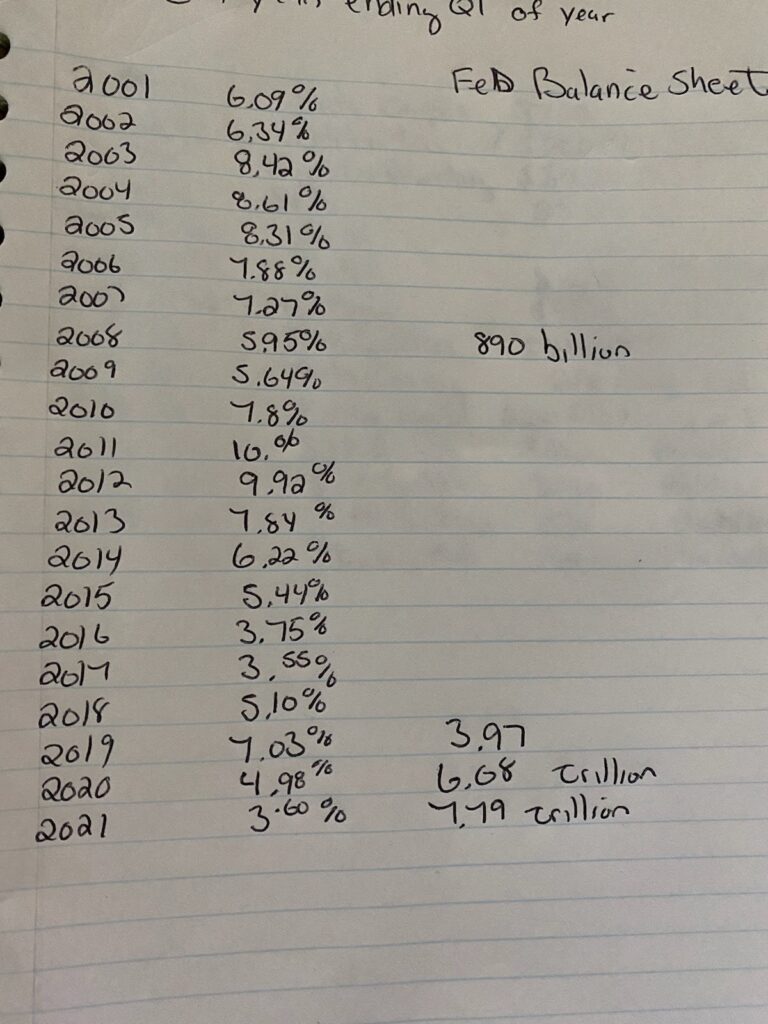

Magnitude of the Adjustments

Watching Fox Business News or CNBC and watching the guests discuss their estimates for the Non-Farm Payroll number, never did I imagine the magnitude of the adjustments being made. For example, if the estimates ranged from 175k to 250k, I thought the Seasonal adjustment might be 40-50,000. Not the magnitude I found. Let’s have a look:(remember that the Seasonally adjusted data released is the real number plus( or minus) the numbers for the month listed below):

Jan: 3,050,000

Feb: (691,636)

March: (603,545)

April: (853,545)

May: (593,929)

June: (326,364)

July: 1,271,000

August: (156,700)

Sept.: (378,300)

October: (780,300)

Nov: (277,400)

Dec: 347,300

Seasonal Adjustments Leave False Impressions

Looking at just how large the adjustments are for each month is puzzling. Take a look at the average January adjustment listed :3,050,000. In reality, the economy could actually shrink by 2,000,000 jobs and the BLS will report that we added 1,050,000 jobs for the month of January. Does that make sense to you?

It makes no sense to be because what is reported and what is actually happening is not the same.

How do businesses make solid decisions on what is happening and what they should be doing to take advantage of the data if the data does not reflect the real world?

Is the American public too stupid to understand that lots of jobs are lost in January as the temporary Christmas jobs are terminated? Or do the seasonal adjustments mislead the Public because it is so easy to seasonally adjust giving people the perception of a more level and consistent economic environment?

What’s the Solution?

Because of the disconnect between Seasonally Adjusted Data and reality, I suggest we reduce the reliance on such misleading data. And to dump your investments in one sector and buy in another because of a blockbuster jobs number that is more a work of fiction than fact is likely a mistake.

But those that are profiting from this are those that make money when you buy and sell. They like this volatility created by the data because it causes knee-jerk reactions across the financial spectrum.

An obviously fictionalized number depicting economic activity that is anything but accurate is no way to manage your portfolio.

And that is the Naked Truth.