There are a small but growing group of residents like myself who have been trying to hold our government accountable. We do not look the other way. We insist that our Charter be followed and not circumvented for the convenience of the Mayor or any other elected officials. The rules need to be followed otherwise they will be exploited by one or more individuals.

We are small in number. But we are growing. And we are not going away. What follows below is the result of residents such as myself that are not afraid to hold our government to a higher standard. A standard that should be the starting point and not the Exception.

Why Were Craig Kidd’s Records Requested In The First Place?

A Bit of Background

In the fall of 2015, I worked on campaigns for Coughlin and Endres. While I was at Wilson Road Elementary School, waving signs with Mark Endres for these candidates in font of the school, someone drove past and gave us the finger. All the other voters who we waved to were friendly and polite. Not this one.

“Who was that?” I asked.

“Craig Kidd”, Mark Endres replied. “He is a leader in the Republican Party.”

“No wonder I am not a Republican”, I responded.

Four Years Later

Four years later and Kidd is the Mayor’s assistant. And for several years there have been plenty of rumors about Mr. Kidd and what was going on locally. To summarize it briefly, candidates that could not be considered conservative in the least were being recruited by Kidd(A member of Republican Leadership in Fulton County) to seek office against candidates for City Council that were undeniably conservative, especially on fiscal matters.

Why would Republican leadership be recruiting candidates that were liberal? Rationally that makes no sense to someone like me, who is principled in their beliefs.

Johns Creek is small and rumors travel fast. Rumors that opponents of candidates Endres and Bradberry and Coughlin from years past were being coached by Bodker and Kidd were frequent. And as we know those candidates lost.

Time To Prove Or Dismiss The Rumors

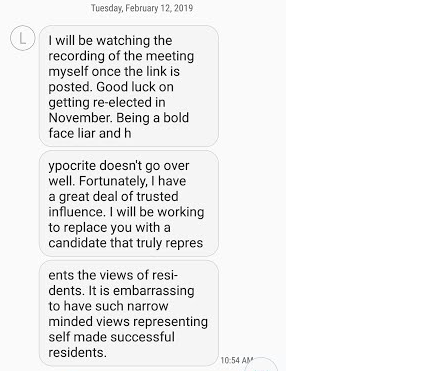

In the spring of 2019, several things happened that heightened the awareness of what was going on to those residents that wanted to hold our government accountable.

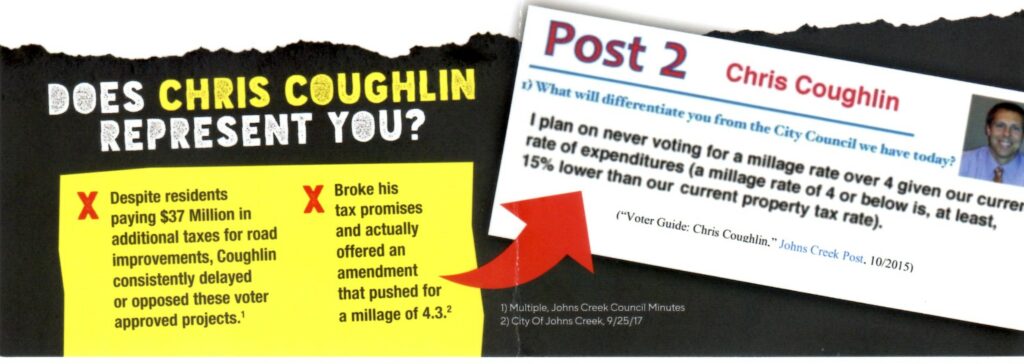

The pursuit of Gateway Markers by the Convention and Visitor’s Bureau, led by Lynda Smith, contained threats that were not so veiled against Coughlin, who dared to challenge the return on investment Gateway Markers would provide. Coughlin was told that there would be candidates in the fall to run against him because he was not supporting the CVB.

Endres was also at the same time catching hell for daring to report to Council what she had heard at CVB meetings.

There were rumors that the Mayor and Kidd were working to turn Johns Creek “blue” after McBath and Kausche both won in 2018.

Many of us debated why so called “Republicans” would do that. The answer is simple. They want to maintain their hold on power as long as they can. And if they have to compromise in certain areas then they will do so as long as they can maintain their control.

The FOIA Request

Most of us call it a FOIA request(Freedom of Information Act). But for local governments it is a GORA(Georgia Open Records Act). In order to get to the truth as to whether candidates were being recruited by Kidd and Bodker to run against duly elected candidates(Chris Coughlin), the activities of Kidd would need to be reviewed.

| Records Requested * | For Craig Kidd I seek these public records.1. Text messages on city phone including phone number/contact from January 1, 2019 – September 30, 2019 2. Telephone log of all incoming and outgoing calls on city phone from January 1, 2019 – September 30, 2019 3. Copies of all emails to and from @FultonGOP.org, 4. Audit of website activity for city phone and city computer assigned to Craig Kidd April 1, 2019 – September 30, 2019 (what websites has he visited and for how long) |

As you can see, the only materials requested were from City devices. The search was limited to the issues stated above. This was not a wild goose chase but a specific and narrow search.

Five Minutes

Within five minutes of reviewing the information I had picked up from City Hall, it became very clear that the rumors were not just rumors but facts. These are not alleged, made up, contrived or fake news. The information was pulled by City Officials who are required by State Law to do just that.

The Mayor is an elected official. His assistant is an employee of the City. Here is the text exchange they had on March 2, 2019(I have bolded the crucial messages in the thread below-the “Me” in the thread below is the Mayor’s assistant as it was his text records I requested):

[3/2/19, 10:43 AM] Mike Bodker : Did you see the news about Sharon

[3/2/19, 10:43 AM] Me: No

[3/2/19, 10:46 AM] Mike Bodker : She resigned

[3/2/19, 10:46 AM] Mike Bodker : Effective late March

[3/2/19, 10:47 AM] Me: She was getting quite frustrated with the city’s lack of development desire.

[3/2/19, 10:48 AM] Me: Do we know where she’s going?

[3/2/19, 10:51 AM] Mike Bodker : Yep as am I

[3/2/19, 10:55 AM] Me: Things will get once city hall and linear open. People need to see it.

[3/2/19, 11:03 AM] Me: I spoke with Kausche’s aide. I think she and I will have a meeting this week to discuss November. I imagine I will blow her mind.

[3/2/19, 11:50 AM] Mike Bodker : She said to Warren back to NY to be with family

[3/2/19, 11:51 AM] Mike Bodker : Talked to Angelika Friday about the same topic she keeps getting no way from folks

[3/2/19, 11:52 AM] Mike Bodker : I hope we can trust her given that Stephanie was already telling people I want dems to run

[3/2/19, 11:53 AM] Me: I presume that was a leftover from the Bradberry Horton race. For the time being we will have to ignore the raw partisan talk. It will be tough but long term it’s best.

[3/2/19, 11:53 AM] Me: If we can bring the chamber in on three November talks then Angelica will see how strong our intent is.

[3/2/19, 11:55 AM] Mike Bodker : Arts and chamber

[3/2/19, 11:56 AM] Mike Bodker : We need various Constituencies to align

[3/2/19, 11:56 AM] Me: Already on that. The arts community is looking for a candidate. I told them more than one. Sadly they put all their energy into Horton so when she passed, they were left flat footed.

[3/2/19, 11:57 AM] Me: I’m trying to get Baughman and Lynda Smith flaking. Somehow, they don’t know each other

- Me: Craig Kidd- Mayor’s Assistant

- Sharon: Sharon Ebert (Community Development)

- Kausche: Agelika Kausche-Democrat who won Georgia’s District 50 Race

- Stephanie: Council Member Stephanie Endres

- Bradberry: Council Member John Bradberry

- Horton: Vicki Horton, who ran for the same seat as Bradberry and lost in a runoff

- Baughman: Maestro for JC Symphony and lead on the Legacy Center (new name for Performing Arts Center

- Lynda Smith: Head of Johns Creek Convention & Visitor’s Bureau

- Arts: Art Community who is pursuing a Performing Arts Center and Gateway Markers(one of the constituencies)

- Chamber: Johns Creek Chamber of Commerce(another of the constituencies

Reviewing the results from a request under the Georgia Open Records Act I filed with the City of Johns Creek, it became obvious that resources(staff and equipment) were being used to engage in political activities that should have been done outside of the office and not using City equipment(cell phones, computers, etc).

You can read all the messages between the two using the link below:

https://ejmoosa.com/wp-content/uploads/2019/12/Messages-with-Mike-Bodker.txt

What Is The City Charter?

The Johns Creek City Charter is similar to the US Constitution. It is a framework for the rules under which our City operates and what is allowed and not allowed. Elected officials swear an oath that they will faithfully execute the City Charter of Johns Creek.

What Does The City Charter Say About This Behavior?

Section 2.15 of the City Charter Section C states the following:

No elected official, appointed officer, or employee of the city or any agency or entity to which this Charter applies shall use property owned by such governmental entity for personal benefit, convenience, or profit, except in accordance with policies promulgated by the city council or the governing body of such agency or entity.

The replacement of Council Member Chris Coughlin from the Johns Creek City Council would have made it much easier for the Mayor to proceed with his agendas.

In the text messages using City issued cellphones and during normal business hours, we see a conversation that describes the Mayor’s frustration with the lack of development desire.

Next, we see the assistant discuss contacting the aide of Angelika Kause(D-50), our state representative. Rumors were circulating around Johns Creek that the Major and his assistant wanted to turn Johns Creek blue. These text messages confirm that there indeed was a strategy to do this.

We also see that the Mayor confirms that he has also contacted Kausche on the same topic and the answer from folks is no way.

It also makes it clear that the Mayor and the assistant were reaching out to other constituencies in an effort to field opponents for Council Member Chris Coughlin, who was going to run for re-election to the Johns Creek City Council. We also know that they were successful as Coughlin had three opponents during the race. Two of the opponents were both connected to the constituencies mentioned in the text messages above, and spent more than $100 thousand dollars in this effort.

What Needs to Happen Next?

When a resident wins election to the City Council they take an Oath to uphold three very important documents. Here are a few portions of that Oath:

I, do solemnly swear that I will faithfully execute the office of Council Member of the City of Johns Creek, and will, to the best of my ability support and defend the Constitution of the United States, the Constitution of the State of Georgia and the Charter, Ordinances and Regulations of the City of Johns Creek.

I will truthfully, honestly and faithfully discharge the duties of my office.

PORTIONS OF THE CEREMONIAL OATH OF OFFICE FOR THE CITY OF JOHNS CREEK

The second line I have included above is also critically important. To me this line means that you will do what is right, and not just what is in your own best interest.

The issue was taken up at the last City Council work session on December 9th, 2019. And it seems that this Council up to this point is delegate their responsibility to resolve this issue to the City Manager and an independent investigator.

The facts seem undeniable. City Property was used to achieve specific objectives that would benefit the Mayor for personal benefit and convenience. The Mayor directs the Assistant that he needs multiple constituencies to align. The Assistant responds that he has told them he needs more than one candidate.

We know this to be true as Council Member Chris Coughlin had candidates from the constituencies mentioned. We know that these constituencies did try to align to defeat Coughlin, although they failed.

And unless there is a policy that has been approved that states City Resources can be used for campaign purposes, recruitment of candidates, and for the personal benefit and convenience of the Mayor and his assistant, then the Charter has been clearly violated.

Residents of Johns Creek do not vote for the City Manager. While the Police Chief has the utmost respect, this is not a criminal matter. The outcomes for violating the City Charter are not necessarily criminal matters and those that violate the Charter do not necessarily go to prison.

What they did vote for are the seven bodies that serve as the Johns Creek City Council. And like it or not they have a job that they have sworn an oath to perform.

What Is Their Duty?

The City Council is required to enforce the City Charter. And they are required to enforce it for violating even one provision of the Charter. If they do not then they themselves are violating the City Charter according to Section 2.16 (a) (1) & (5) and also should be removed accordingly.

Section 2.16 of the City Charter states the following:

Sec. 2.16. – Removal of officers.

(a)The mayor, a council member, or other appointed officers provided for in this Charter shall be removed from office for any one or more of the following causes:

(1)Incompetence, misfeasance, or malfeasance in office;

(2)Conviction of a crime involving moral turpitude;

(3)Failure at any time to possess any qualifications of office as provided by this Charter or by law;

(4)Knowingly violating Section 2.15 or any other express prohibition of this Charter;

(5)Abandonment of office or neglect to perform the duties thereof; or

(6)Failure for any other cause to perform the duties of office as required by this Charter or by state law.

Can This Behavior Be Defended?

Would the Mayor argue that he does not know the Charter? He shouldn’t. Otherwise that would then confirm incompetence. Another reason to be removed from office according to the City Charter.

Could the Mayor have his assistant do whatever he desires? No. The assistant is a City employee and is also bound by the City Charter.

In Conclusion

The action of the Mayor’s assistant to knowingly pursue candidates to run against sitting Council Members, at the Mayor’s direction, in an effort to change the political makeup of the Johns Creek City Council, using City Equipment, during working hours being paid a taxpayer-funded salary and benefits, is clearly a violation of the Johns Creek City Charter.

For an individual in the Fulton County Republican machine to be recruiting democrats to run for City Council? That’s up to those that call themselves Republicans. That’s one of the reason many of us are no longer republicans. We will see if they police themselves or not.

The assistant to the Mayor reports directly and only to the Mayor. Who should have been making sure that this was not happening as a function of their daily job, rather than giving the guidance to pursue the objectives we saw stated above? Only one person: Mayor Bodker.

Where Does That Leave Us?

One or more of the Council Members need to take action and take action soon. If you are not going to enforce the Charter, I’d encourage you to resign. We can find residents who are willing to enforce the Charter on behalf of all residents, and not just when it is convenient.

It is past time to lead by example and address what we know has been going on and put an end to such behavior.

“You will earn the respect of all if you begin by earning the respect of yourself. Don’t expect to encourage good deeds in people conscious of your own misdeeds.”

Gaius Musonius Rufus- Roman Stoic philosopher