The Double Whammy of Inflation and Shrinkflation Are Just Getting Started

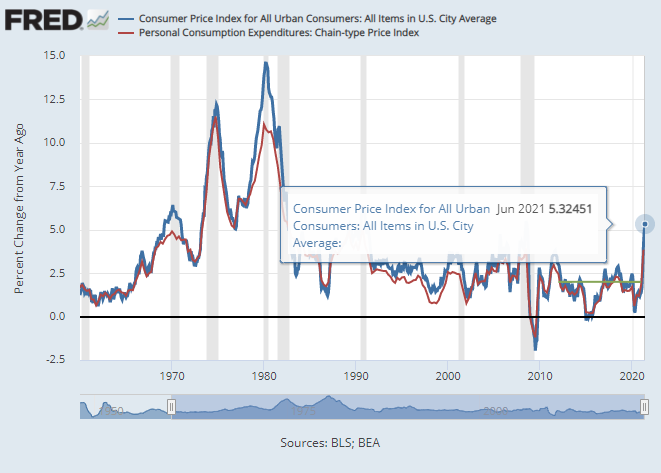

In a steep acceleration for prices where many people live, FRED is gracious enough to show us the rate of inflation for June 2021 along with a chart dating back well before 1970.

Ironies

Ironically, the story linked above justifies higher inflation than zero to prevent deflation(prices falling) yet if you look at the chart image, deflation has rarely been an issue over the last fifty years(2010).

Shrinkflation: What You Think You See May Not Be What You Get

Pictured below are two Tillamook Ice Cream containers. The product on the store shelves offered both containers for the same price: $5.99. That translates to an increase of 14.2% in price. Because the containers shrank and the prices are the same we call this Shrinkflation. And it stinks.

It stinks because unless you look carefully you might not notice the differences.

Have you looked closely at your shredded cheeses lately? Choose carefully. While many are still 8 ounces(Two Cups) more and more are down to 7 ounces (or less).

Packages across the board are shrinking and this hides the real inflation we are seeing every day as they hold prices the same but you get less.

Hiding the inflation does all consumers a disservice. If the inflation is hidden from us, then we as consumers are not getting a clear perception of what our currency can and cannot buy.

Your dollars are losing their purchasing power. And at 5% or higher inflation, they will be losing that purchasing power faster than anyone has witnessed since the 1980s.

Unless you are getting salary increases to keep up with inflation, you and your family are going to be falling behind economically.

“Adjusted for inflation, hourly compensation fell 2.7 percent in the second quarter, data released by the Bureau of Labor Statistics on the nonfarm business sector showed Tuesday.” Source: Breitbart

Conclusion:

Choosing a rate of inflation at 2% or higher and calling your currency stable is simply false. Sooner or later the flames of inflation will jump the perceived control of the Fed and burh through the economy creating havoc and harm.

The US Dollar needs to be tied to a stable form of money such as gold, and interest rates need to be allowed to rise and fall as supply and demand dictate.

The damage we are doing to our economic well being will not be reversed any time soon and the cures for the damage are likely to accelerate the damage as we have seen in years past.