One of the greatest mysteries to me is why we see no economies of scale the bigger cities get and the bigger governments get. And I think that I am on the brink of resolving that mystery for myself finally.

For our example, we will take two municipalities of obviously different size: Johns Creek and Atlanta. Both have the same state government, operate in the same environmental and economic environments and co-exist 15 miles or so apart.

And without evening providing the numbers that support the statement, we all know that it is much more expensive from a tax perspective to live in Atlanta than Johns Creek.

I have decided to provide the numbers after it was suggested that they were important.

Brief back of the envelope calculations shows that the City of Atlanta spends $1265 per resident while Johns Creek spends $637. And on property taxes. the City of Atlanta has a millage rate 30% higher than Johns Creek.

As a more or less rational thinker, this has left me puzzled more often than not. What is it that makes it more expensive per capita to provide services to the public, which seem to defy the concept of Economies of Scale that function flawlessly in other aspects of our life?

And then it hit me. It’s NOT the economies of scale that are at question. It’s the scope of government services provided.

At this point I am going to add another city to our conversation. This one is fictional, but we all have a good understanding of how it is defined: Mayberry.

The city of Mayberry provided the most basic of services for the common good. Court, jail, police, fire and education.

All the residents were potential beneficiaries of these services.

But when a city gets larger, like Johns Creek has, then more services are provided. Wants seem to morph into needs. And these services may not benefit all citizens but a sub-section. At first, it might be that a new service benefits 90% of the public. We tax all for the benefit of those 90%. And 10% pay for services they never use.

Then the City grows larger. Soon we add additional services, and then more additional services until the new services aret being used by 10% or less of the population and are being subsidized by the 90% that are not using them.

The larger the city the smaller the beneficiary group as a % of the whole needs to be.

Much to the chagrin of dog lovers, I’ll use the example of dog parks. (and I love the name of the Chattapoochie Dog Park in Gwinnett so I am not a total grump). Here’s a service provided by municipalities that only benefits dog owners. More specifically, it only benefits that sub-segment of dog owners that want to take their dogs to a park to roam around. If 1 in ten residents in Johns Creek have taken their pooch to the park more than 6 times in a year, I’d be shocked.

Were Johns Creek to get large enough, we’d likely have a different park for small dogs, and big dogs. Even larger and we would have one for medium sized dogs.

We see the same effect with Arts Centers, Aquatic Centers, Nature Centers (insert the others you know are coming here). We also see it with other services the City decides that they must provide such as bulk recycling. The list becomes endless as long as there are funds to start the program. And they never end. Get a few federal or state dollars to start and it’s a certainty to get started and be with you forever more.

Which brings us back to my original observation. There are no economies of scale for bigger and bigger cites because the scope of the services these cities provide expand in such a way that there are fewer users as a % of the population, forcing the majority to subsidize them. By the end the 99% are funding programs for the 1% that use them.

How does one reign in the “service creep” that cities seem to engage in the larger they get?

One answer would be to set a minimal level of actual users that a city expects to see from this service. Fifty per cent would be a good starting point for discussion’s sake.

Another answer would be to cut the funds flowing into the cities that fund such projects of such a narrow scope. To do so you will need to be ready to speak up to your local government and say “NO!”.

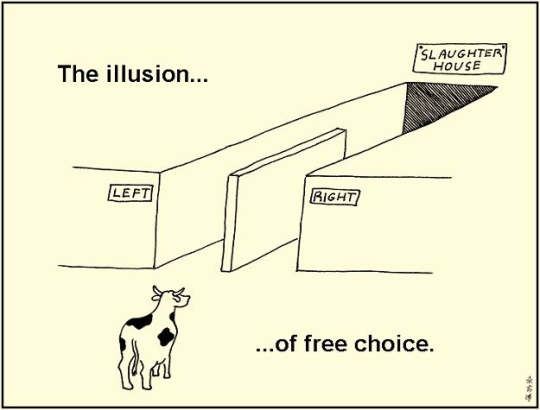

As a Libertarian, this is exactly why I am for a smaller government. Let’s do the things that we need to do for everyone’s benefit, and do them the best we can.

Then we could see economies of scale. We could lower our taxes, and those with dogs, for instance, could fund their own private dog park with their own dollars.

Otherwise, where does the “Service Creep” end?

That’s my opinion. I’d love to hear yours.

[thumbs-rating-buttons]